Mortgage Lenders are Tightening their Guidelines

In this dynamic real estate market, lenders are offering historically low interest rates and are facing a deluge of applications. However, in this rapidly-escalating market they are being cautious on who they lend money to and are making sure all buyers are qualified and capable of affording their loan. My goal is to provide all the information you need to help you find great homes and investment properties. Whether you yourself have children or not, you may want to consider purchasing properties in desirable school district areas to help with resale value.

How Are Lenders Tightening Their Guidelines?

1. Higher FICO Score

Many lenders have increased their minimum FICO score to the 700’s. They require a higher credit score to ensure the responsibility of buyers. This is especially true on loans that require less of a down payment.

2. Debt-To-Income Ratio

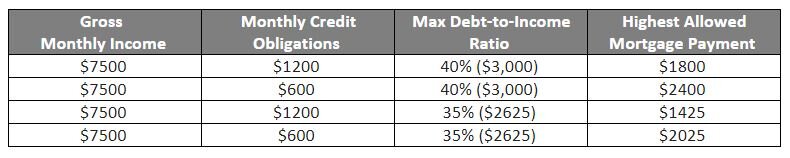

Lenders are also decreasing their maximum debt to income ratio that they will allow on a loan. A debt-to-income ratio is the amount of monthly credit obligations a buyer has, divided by gross monthly income. Many lenders are now requiring a debt-to-income ratio of less than 40% and are very strict on making exceptions.

3. Strict Loan-to-Value

As home values continue to increase throughout the country, lenders are staying strict on the maximum loan to value they are allowing on a home. This is especially pertinent when appraisals come back below the sales price. When lenders will not budge in allowing buyers to go over the loan to value stipulated by the loan, buyers and sellers must compromise on sales price or buyers must put more money down to meet the loan to value requirements.

How Can Buyers Secure a Loan?

Following these steps may increase your odds of being approved for a mortgage:

1-Prepare by saving enough money for a down payment. The more money available to put down, the more flexibility you will have.

2- Decrease credit obligations- the fewer payments owed each month for minimum credit card payments, car payments, and more, the more flexibility you will have in mortgage loan payment.

The chart below shows an example of the maximum mortgage payment based on various Debt-to-Income Ratio caps. It shows the striking difference in what a buyer might be able to afford based on current debt obligations.

It is still very possible to get approved for a mortgage and take advantage of historically low interest rates. Strict mortgage guidelines help buyers enter into an affordable and sustainable homeownership. It also protects our housing economy overall.

For information regarding all things real estate, check my website and blogs at www.JensRealty.com. If there is a subject you think I should cover, let me know!

If you would like information about buying, selling, or investing in real estate - call, text, or email anytime. I’m always here to help! Thank you,

Jennifer Suemnicht - Jen's Realty - RE/MAX Metro Realty, Inc.

www.JensRealty.com / 206-550-1676